-Darren Leavitt, CFA

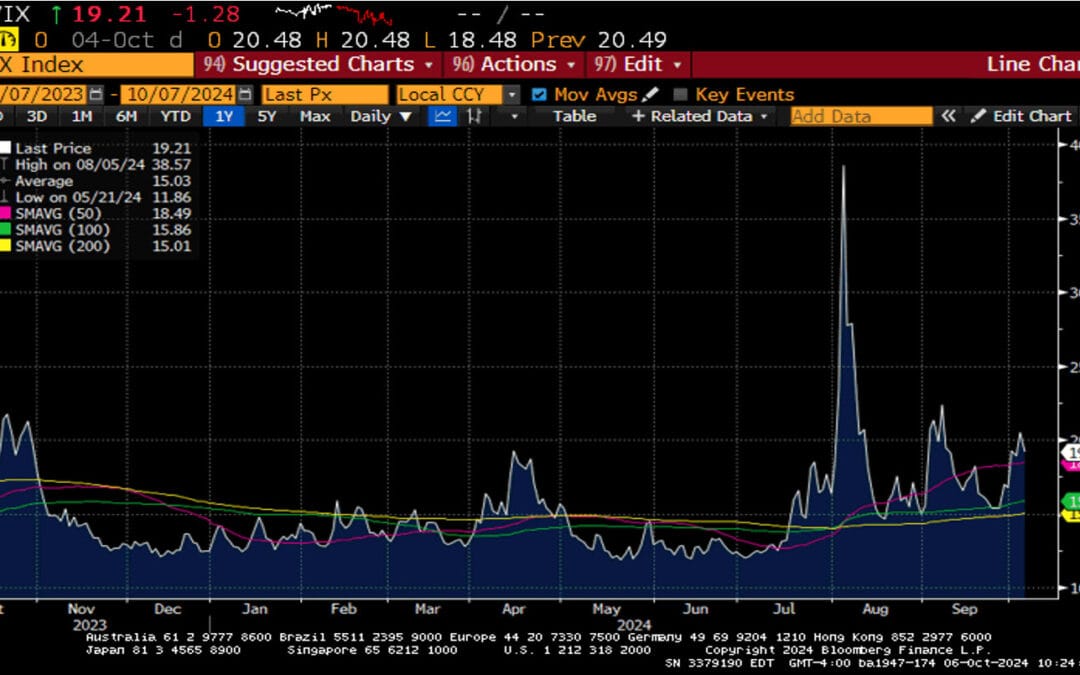

The S&P 500 closed higher for a fourth consecutive quarter, the first time it has done so since 2011. Investors continued to face a challenging macro environment. Escalating tensions in the Middle East, a Longshoremen’s strike, the aftermath of Hurricane Helene, and a packed calendar of economic data and central bank rhetoric, which all contributed to a hectic week on Wall Street.

An eminent retaliation from Israel on Iranian assets seems likely and focused on Iran’s energy infrastructure. The Biden administration appeared to endorse that type of response but pushed back on a plan to target Iran’s nuclear assets. Israel continues a land campaign in southern Lebanon while bombing targets in Beirut and Gaza. The US also destroyed several Hezbollah assets in Yemen over the weekend. The escalation sent oil prices significantly higher and briefly put a bid into safe-haven US Treasuries.

A Longshoremen’s strike that was estimated to cost the economy $4.5 billion a day and perhaps even more if it were to carry on for weeks was thankfully suspended. The two sides will allow more time to negotiate a comprehensive deal but did find common ground on a 61.5% wage increase over six years. On January 15th, the two sides will sit back at the bargaining table to iron out other details, including dock automation and job security.

The death toll from Hurricane Helene increased to 227 across six states, with several other persons still missing. The Category 4 storm is the deadliest hurricane to hit the US since Katrina in 2005. The debate about the Federal government’s response is notable, especially in an election year, and there is no doubt the damage done will have economic ramifications that investors must address. Unfortunately, as I write, Milton has formed into a hurricane in the south Gulf of Mexico, and its trajectory is centering on Tampa Bay with expected impacts on southeastern Alabama, southern Georgia, southeastern South Carolina, and southeastern North Carolina.

The S&P 500 hit another all-time high and added 0.3% on the week. The Dow increased by 0.9%, the NASDAQ advanced by 0.1%, and the Russell 2000 fell by 0.5%.

The real action in markets took place in fixed income and currency markets as investors recalibrated, once again, their expectations around central bank monetary policy. Treasury markets sold off hard on labor data that surprised the upside and on Fed Chairman J Powell’s hawkish comments at the National Association for Business Economics, where he suggested the Fed was in no hurry to make additional rate cuts. The 2-year yield increased by thirty-seven basis points to 3.93%, while the 10-year yield jumped by twenty-three basis points to 3.98%. Fed Funds futures now assign no chance of a fifty basis point cut at the November meeting and a 97.4% chance of a twenty-five basis point cut. The probability of a twenty-five basis point cut may still be too aggressive. The Fed will get another look at the October Employment Situation report before its November meeting along with several other labor-related data sets.

Oil prices soared on escalating tensions in the Middle East. WTI prices increased by $6.25 or 9.2%, closing at $74.40 a barrel. The price of gold was unchanged on the week, closing at $2667.90 an Oz. Copper prices increased by a penny to close at $4.57 per pound. Bitcoin’s price fell by $3500 to $62k while the US Dollar index posted its best weekly move in two years with a 2.1% increase to close at 102.53.

The economic calendar was packed, with all eyes focused on Friday’s Employment Situation report. Non-farm payrolls increased by 254k, well above the estimated 150k. The August and July figures were also revised higher, pushing the 3-month average to 186k from 140k. Private Payrolls grew by 223k, again well above the consensus estimate of 125k. The Unemployment rate fell to 4.1%, down from 4.2%, and the decrease occurred despite increased available labor. Average Hourly earnings increased by 0.4% versus the estimated 0.3%. On a year-over-year basis, wages grew by 4%, up from 3.9% in August. The Average workweek came in at 34.2 hours versus the estimated 34.3 hours. Overall, it was a very impressive report, sending investors back to the drawing board to recalibrate US monetary policy. Initial Jobless Claims increased by 6k to 225k, while Continuing Claims fell by 1k to 1826k. ISM Manufacturing continued to be in contraction mode with a reading of 47.2. However, ISM Non-Manufacturing expanded at the fastest pace since February of 2023 at 54.9, well above the expected 51.7.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.